Learning Library

UPDATED JUL 15, 2022

Refinance process revealed: How to complete your auto refinancing application

About our application steps and helpful information

By

Caribou

9 min read

Ready to get started?

Easily start the refinance process through Caribou. Apply in minutes.

Applying for refinancing through Caribou

Welcome to the future of auto refinancing. Here at Caribou, we specialize in helping you refinance your car loan and look for a great deal. We are reinventing the refinance process with our innovative refi tools and marketplace integrations combined with decades of experience.

The result is a next-generation refinance platform on the cutting edge of the refinance industry. Our lending partner network includes the best lenders from around the country and our experienced loan officers are with you every step of the way. Check out our application walk-through below.

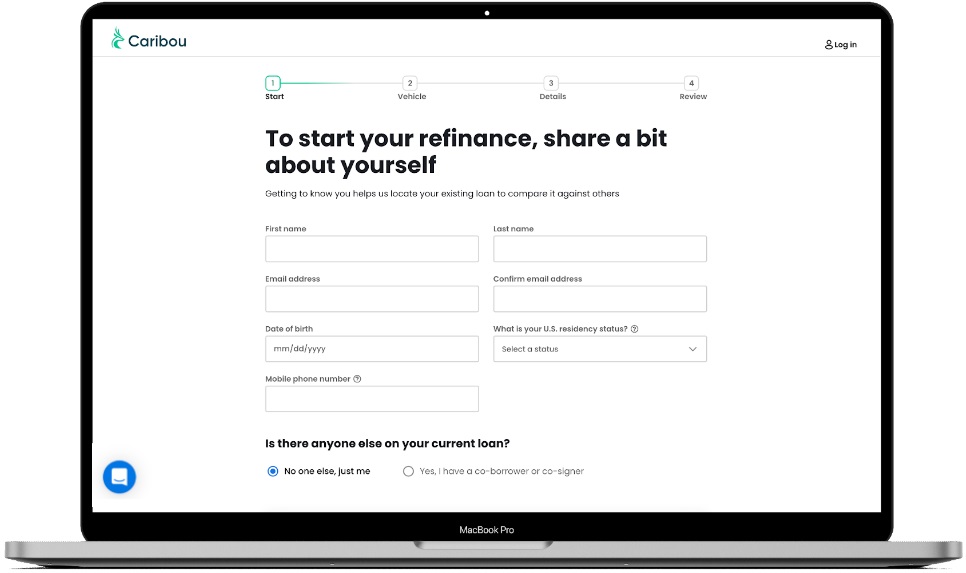

1. Start the process: Submit basic information

To start the refinance application process, we need some basic information including your first and last name, email address, phone number, birth date, and where you live. This is because our automotive refinancing lenders provide service in different areas around the country. We currently provide auto refinancing in all U.S. states except in MD, MS, NE, NV and WV. Providing your location information gives them the necessary details to make you a refinancing offer.

Enter refinance co-borrower (if applicable)

If you are using a co-borrower while refinancing your vehicle, this is where you need to enter the rest of their information. Their information is similar to the information you just entered for yourself. It includes their contact information, annual income, where they live, how long they have lived there, and if they rent or own. Remember that adding them to your refinance contract may be able to help you qualify for better rates.

Wondering if you can refinance your car where you live through Caribou? Check with us. We offer auto refinancing in all fifty states except in MD, MS, NE, NV and WV.

Start the refinancing process

Easily start the refinance process through Caribou. Apply in minutes.

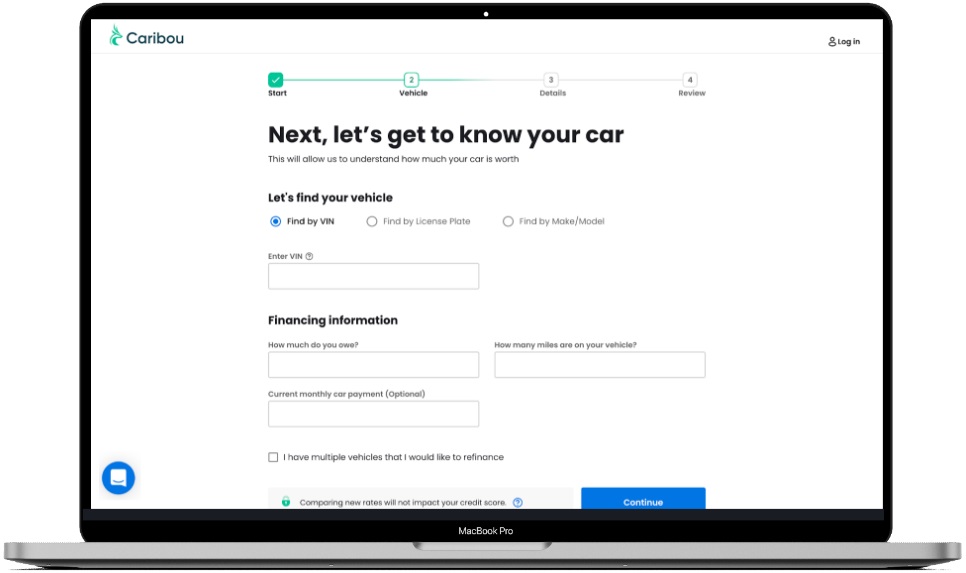

2. Submit your vehicle info

Submitting your vehicle information is the next step in the process. We need this info to get an accurate vehicle valuation and provide you with personalized refinance offers. This is also required so lenders know which vehicle you are refinancing along with the vehicle's options, any special features, modifications, and other key details that affect its value. You can easily find your vehicle’s information by performing a vehicle identification number, or VIN, lookup. Another way to look for your vehicle info is by using our Department of Motor Vehicles, or DMV, search integration. You can do this by entering your license plate number and state. Alternatively, you can manually enter your vehicle information.

Find by VIN

Your vehicle's VIN number is usually the fastest way to import your vehicle specifications, make, model, and other features into our refinancing platform.

Find by license plate

You can enter your vehicle information easily by using your license plate number and entering your state. Our platform connects directly to the Department of Motor Vehicles in your state.

Find by make and model

You can also find your car by vehicle make and model. This is a good way to enter the vehicle data if you do not have the plate number or VIN on-hand. To do this, add the year, make, model, and style.

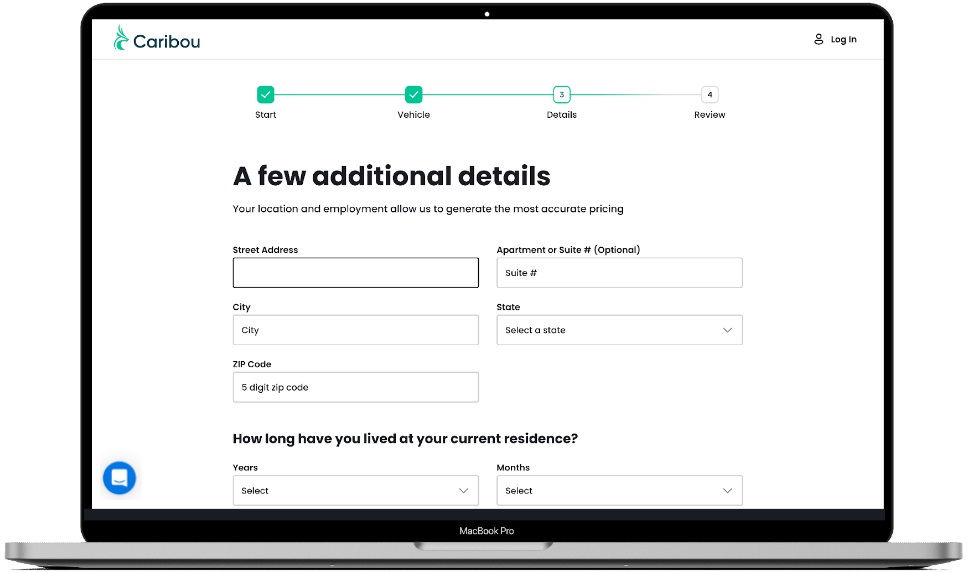

3. Enter additional personal information and income

In this step, you will need to provide lenders with a few more details so they can create your customized refinance offers. They need to better understand your living and financial situations to provide you with the most competitive refinance offer for your loan. Think of this application step as a personal interview where we get to know you. When you finish entering this information, we perform a soft credit pull which will not affect your credit score+ to see credit report information.

Enter your street address, city, state, zip code, and how long you have lived there. We need your location details to match them with lenders in your area. Also, select the option for whether you rent or own your residence along with the associated rental or mortgage payment amount. Finally, enter your yearly income and employment status to complete the personal information picture for lenders.

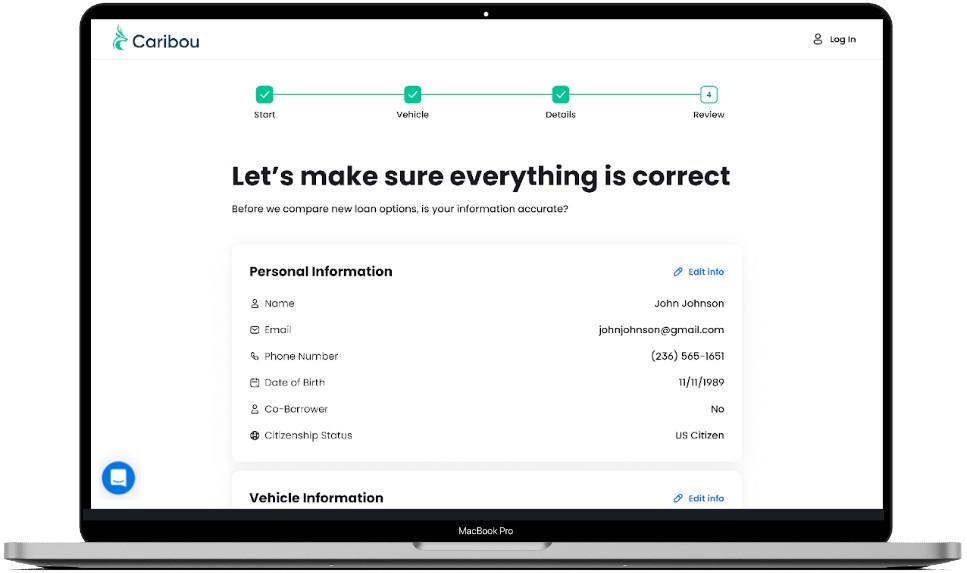

4. Verify personal and vehicle information

Verify that all of your personal, co-borrower (if applicable), and vehicle information is correct. This information is displayed on the confirmation screen. If anything is misspelled, incorrect, or inaccurate, use the edit button to make changes and corrections. Hit the "Submit information" button to check your rate when everything looks accurate and you are ready to move forward in the refinance process.

Pick up where you left off

Good to go? Jump into the refinance process or pick up where you left off. Our loan officers are ready to answer your questions.

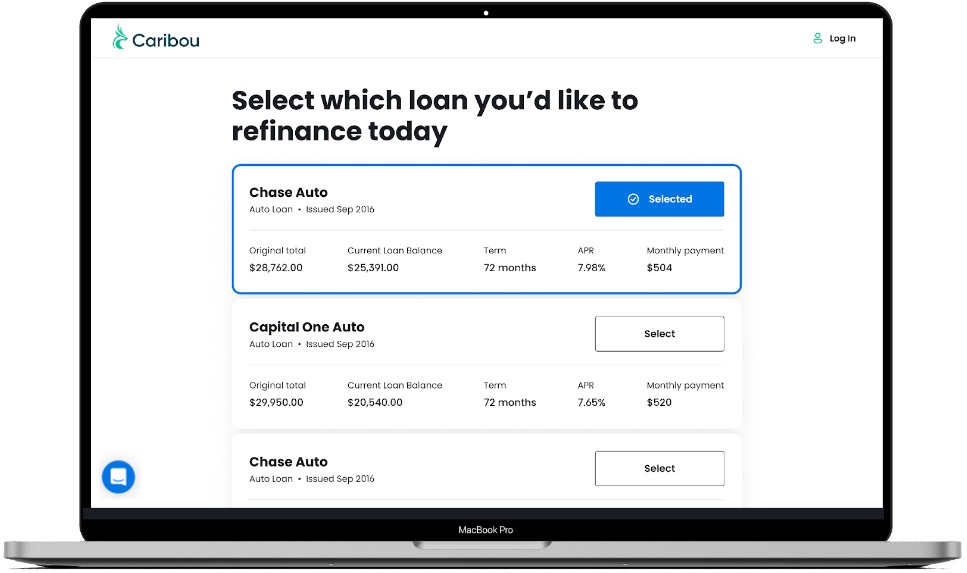

5. Select your existing auto loan

Next, you need to select your existing car loan you would like to refinance. Our platform will perform a soft credit pull+ using the information you provided earlier in the refinance process. Using this information, we can view existing loans on your credit report and import them directly into your refinance application. How cool is that!?

Review the imported loans, and find your existing loan. Use the "Select Existing Loan" button to select it. Make sure the original loan amount, current loan balance, term, APR, and monthly payments are accurate. If you cannot find the loan you want to refinance, use the "None of the Above" option at the bottom of the page to continue using estimated amounts.

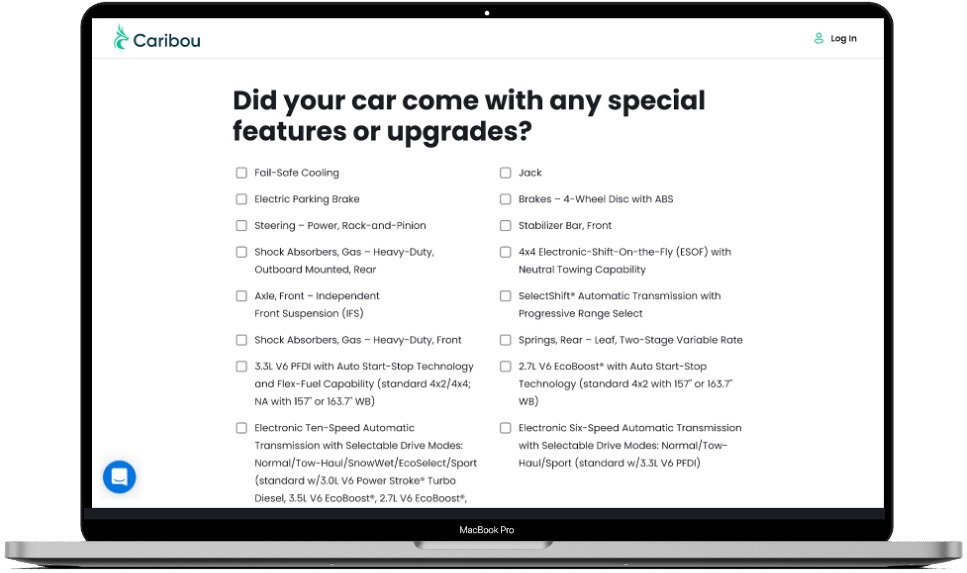

6. Check your vehicle options

Help us understand more about the vehicle you are refinancing. Our platform imports a list of options and features commonly found on your vehicle's make and model. Select the equipped options and features from the provided list to help lenders understand your vehicle's true value.

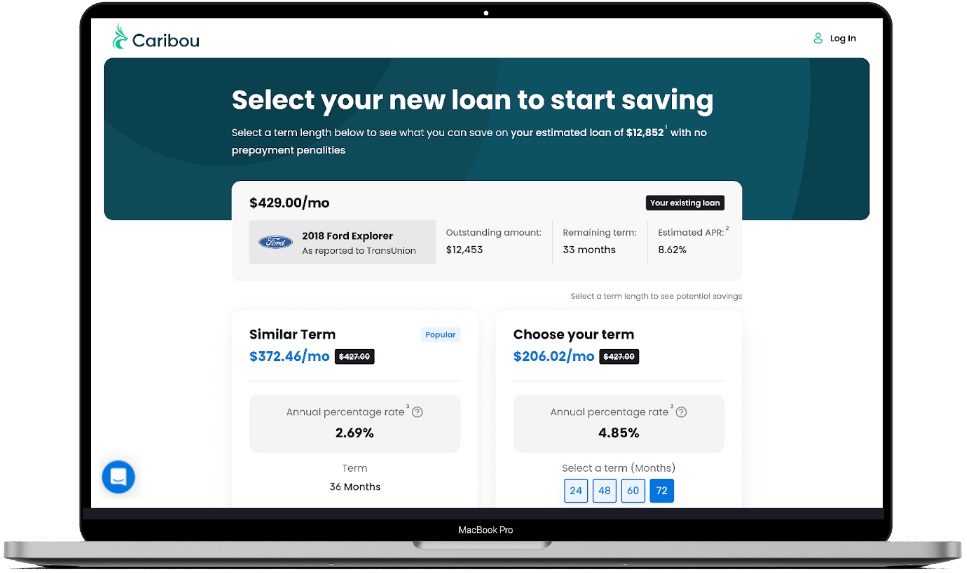

7. View refinance auto loan offers

It is time to find refinance offers! The next step provides available refinance loan options and compares them with your current loan. The options presented can include flexible term loans and the lowest payment options with highlighted savings amounts. Locking in your rate is the next step.

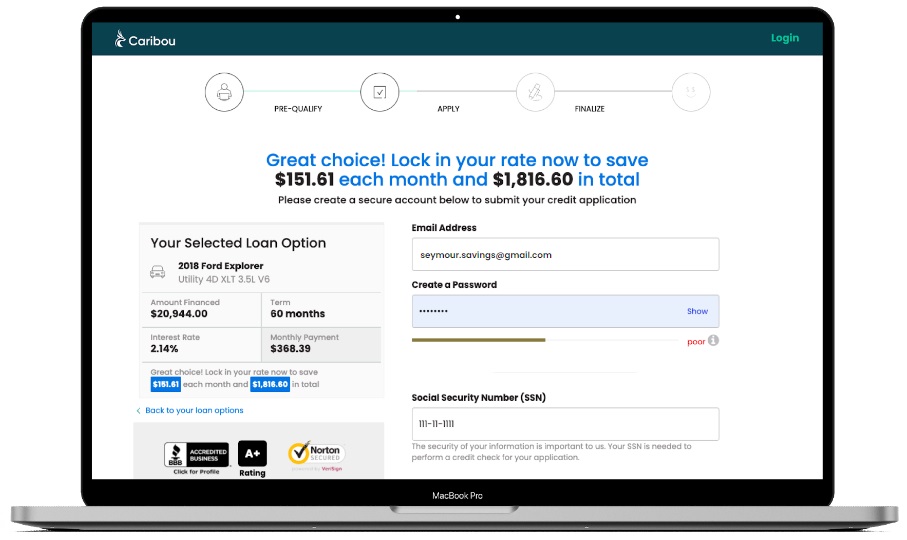

8. Lock in refinance rate

Enter your email address and password to create your account. The summary on this page highlights estimated saved amounts by monthly and total dollar values. Your vehicle and refinanced loan terms are also presented here. Double check this information to make sure everything looks good.

Your social security number, or SSN, is also needed at this step to perform a credit check for your application. This final credit check performs a hard credit pull which usually impacts your credit score+. Your privacy and the security of your information is extremely important to us, and we always securely store your information.

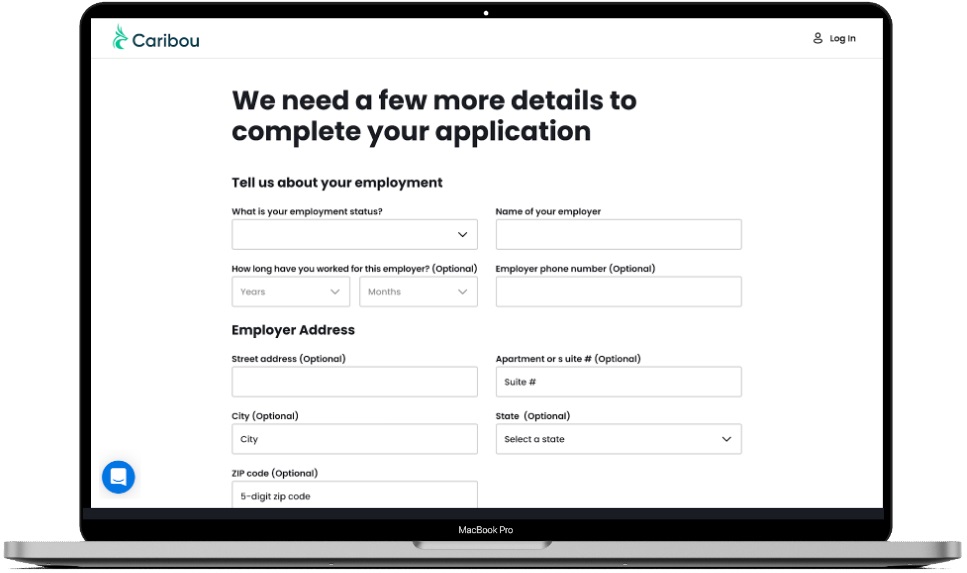

9. Complete any other lender fields

We may require additional information about your residence and employment histories. Our residence history profile needs at least three years of housing information. If you have moved frequently and have lived for less than three years at your current address, complete the residence history fields with previous addresses and information.

Your employment history profile requires similar information. If you have worked multiple jobs over the past three years, please provide those employer details. Include the type of your employment or status, your past employer’s name, your job title at the company, number of years and months worked there, company phone number, and your level of education while working there.

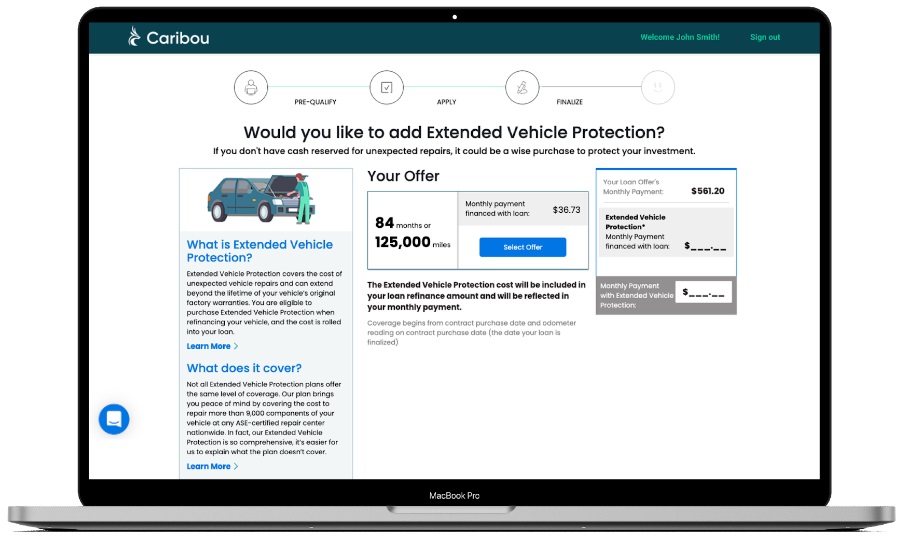

10. Add additional product offers

Refinancing your auto loan gives you the opportunity to help protect your vehicle with special offers. These offers include things like guaranteed auto protection or GAP, extended vehicle protection plans, key replacement programs, and cosmetic care packages. For a small addition to your monthly refinance payment, you can have peace of mind that your vehicle is in good hands.

Car key replacement program

Do you forget your keys often? Have you misplaced multiple key fobs? Our key replacement program might be just the thing you need and can help you out. Learn more about comprehensive car key replacement programs.

Extended vehicle protection

Is your factory warranty expired or nearing its expiration date? Our extended vehicle protection helps cover repair costs and problems you encounter.

Cosmetic care packages

Worried about your car not looking its best? Our cosmetic care packages can keep it looking sharp with dent, ding, tire, and windshield protection.

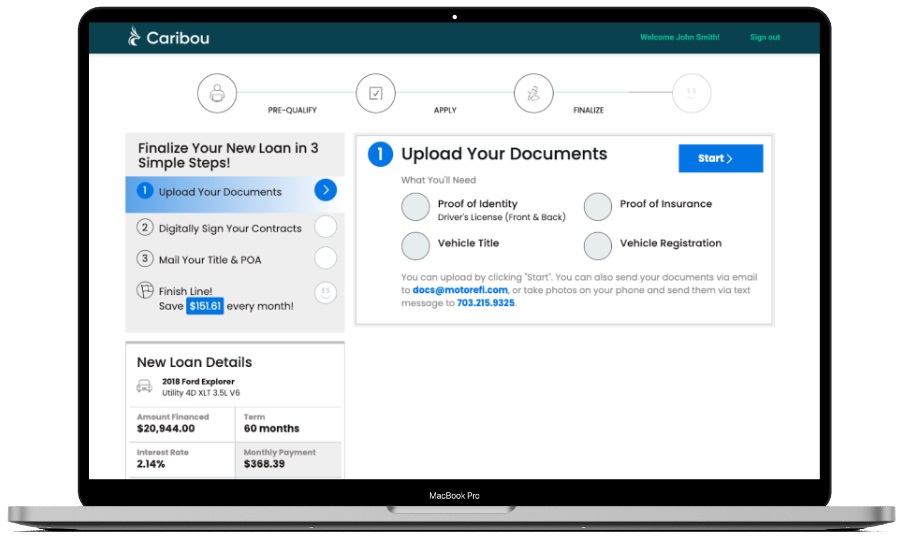

11. Upload your documents

Uploading your documents starts the auto refinance loan finalization process. You will need to send us a few types of documents to confirm the personal and vehicle information you entered earlier in the process. They include your driver’s license, proof of insurance, and vehicle registration.

Make sure your driver’s license is valid and send a picture or scan of the front and back of the license. For insurance, make sure it is for the vehicle you are refinancing and also valid for the current insured term. Your vehicle registration must also be valid for the current year. Send all of these documents over, and we can begin the finalization process!

About Uploads

For uploads, the max file size is 15MB. Documents must be in either JPG, PNG, or PDF formats. For pictures, make sure the entire document (all 4 corners) is clearly visible and all text and information in the document is in focus and readable. Make sure nothing is covering up or obscuring any part of the document or picture. See how to upload your refinance documents.

12. Sign and finalize your auto refinance loan

The refinance process is almost complete! Signing the contract documents and mailing your title and limited power of attorney, or POA, is part of this step. This document allows lenders to act on your behalf in a limited capacity for processing transactions with the Department of Motor Vehicles and when working with the Secretary of State concerning the lien on your vehicle. You must have your limited POA notarized for identity verification purposes.

Once these last steps are finalized, congratulations! You have finished the refinancing process and set up your new loan. If you have any questions or need help with this step, talk to your loan officer. They will be happy to walk you through the process and provide additional information.

Happy Driving and Safe Travels!

- From all of us at Caribou

Through Caribou, you could start saving today!

Mon - Fri: 9am - 8pm EST

Sat - Sun: 9am - 4pm EST

717 17th Street, Suite 700

Denver, CO 80202

* This information is estimated based on consumers whose auto refinance loan funded through Caribou between 3/1/2023 and 3/1/2024, and had an existing auto loan on their credit report. These borrowers saved an average of $115.72 per month. Refinance savings may result from a lower interest rate, longer term, or both. There is no guarantee of savings. Your actual savings, if any, may vary based on interest rates, the repayment term, the amount financed, and other factors.

+ To check the refinance rates and terms you qualify for, we conduct a soft credit pull that will not affect your credit score. However, if you choose a loan product and continue your application, we or one of our lending partners will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

++ Social security number is required should you choose to move forward in the loan application process.

** APR is the Annual Percentage Rate. Your actual APR may be different. Your APR is based on multiple factors including your credit profile and the loan to value of the vehicle. APR ranges from 5.95% to 28.55% and is determined at the time of application. Lowest APR is available for a 60 month term, to borrowers with excellent credit. Conditions apply. Advertised rates and fees are valid as of 3/4/24 and are subject to change without notice.

Terms and Conditions apply. Caribou reserves the right to modify or discontinue products and benefits at any time without notice. Participating lenders, rates and terms are also subject to change at any time without notice. The information you provide to us is an inquiry to determine whether our lenders can make you a loan offer. If any of our lending partners has an available loan offer for you, you will be invited to submit a loan application to the lender for its review. Not all borrowers receive the lowest rate. Lowest rates are reserved for the highest qualified borrowers. We do not guarantee that you will receive any loan offers or that your loan application will be approved. If approved, your actual rate will depend on a variety of factors, including term of loan, a responsible financial history, income and other factors. Offers not available in MD, MS, NE, NV, WV.